I do not know what the future holds. Based on the events that have taken place in the past, the circumstances encountered .. We will take precautions before learning how to deal with such situations in the future again. Illnesses, accidents, natural disasters, unwanted situations .. come without any warning.

The subject has informed me of my experience over the past two years. Such unforeseen circumstances can devastate us mentally and financially. These can be financially tackled with some foresight and planning. Insurance policies help with this. Insurance is like the foundation for financial health. The need for this becomes apparent when unforeseen events occur in the future. Despite the importance of insurance, some people continue to neglect to buy insurance for other reasons.

Without worrying about family

In case of death of the dependent member of the family due to unforeseen circumstances .. Term insurance policy provides protection to the family from financial hardship. Those who are worried about the future of their loved ones should definitely take out a term policy.

In the case of hospital costs

In medical emergencies, everyone wants better medical services and beauty. However, this can be very costly. Comprehensive health insurance policy with adequate coverage .. Helps to provide quality medical care to you and your family in case of emergency. During that time you can focus on your family members without worrying about money.

Critical Illness

Lifestyle related diseases have become very common these days. As a result, there are many people who suffer from complex diseases such as heart disease and cancer at an early age. These require long-term treatment. Also a lot of money is spent. These costs would otherwise be offset by the savings and investments made over the years, damaging the family’s financial health. To cope with such situations you can add the Critical Illness Rider to the general health insurance policy and get extra security. These policies offer a lower premium. In the event of a critical illness listed by the insurance company, the insurance company will pay the entire guarantee to the policyholder, regardless of the cost.

In old age

Older people are more likely to suffer from health problems in old age. Hospital costs and medicines are very expensive. If you take out a health insurance policy keeping in mind the age of you or your parents .. there is no need to worry about expenses. It is the responsibility of every child to provide a healthy and peaceful life for their parents. It is advisable to take out a policy as soon as possible as the premium will also increase based on age.

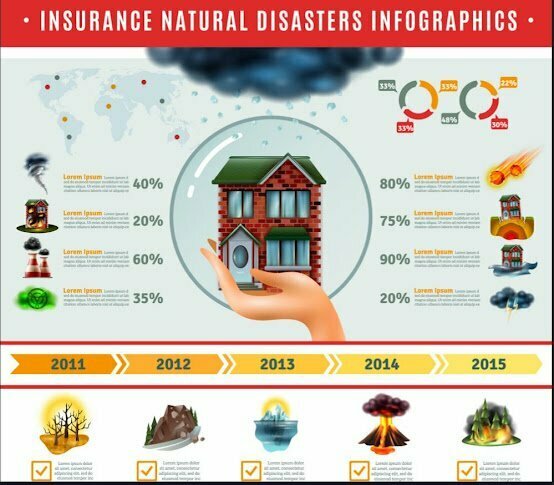

About disasters and unforeseen events

Rising natural disasters are a reminder that not only human health but also homes and businesses need insurance coverage. Therefore, insuring a home or business provides insurance coverage in the event of property damage due to unforeseen circumstances.

Vehicles

It is mandatory to take third party motor insurance in India. However this will not cover the damage done to your vehicle. So taking an important add-on along with a comprehensive motor insurance policy will give your vehicle complete protection.

Thus covering the risk with the insurance policy can avoid financial worries. It is better to stay away from policies that combine insurance and investment. Of these, insurance coverage is low and income is low.