Financial planning is a process that provides a framework for achieving your life goals in a systematic and planned manner. It comes with the goals of determining capital requirements, formulating economic policies and looking to make the best use of scarce financial resources as much as possible.

Increasing the habit of financial planning among the youth is a very difficult task. However, when they plan their financial affairs voluntarily, no one knows where and how to start. Here are 10 good rules that must be followed to plan their finances well.

- Manage your money

- Control your spending wisely

- Manage personal balance sheet

- Dealing with surplus cash wisely

- Create your personal investment portfolio

- Planning for retirement

- Manage your debt wisely

- Cover your losses

- Plan your estate

- Planning your taxes

Manage your money

Managing one’s money does not have to be boring. This is not rocket science and you should not be from a financial background. You only have to show a little commitment.

Deciding to save is the first step towards money management. Saving money is a powerful step towards greater financial independence. Imagine taking a loan from a friend for an emergency visit to the doctor!

If you do not have friends, you will need to swipe your credit card. And you know that credit card is the most expensive loan. Repeat this a few more times and you will be stuck in a debt trap before you even realize it.

You may have many financial goals in mind. Such as buying a vehicle or getting the latest smartphone or wealth. In all these situations, you need money. But where does it come from? You need to save!

Saving money will save you money from debt. Not only this, with the help of regular saving you can become rich. You can achieve your financial goals in a timely manner. Now you are wondering how to save? What’s more important is how much should be saved? As soon as you get your salary, start putting it under different heads. These heads can be costs, EMIs, investments and savings.

Make sure you save at least 10% of your income each month. It can be so easy! But don’t put it in a piggy bank. Idle money in a piggy bank does not grow. A savings bank account may not even get high returns.

Instead, you can invest this amount in a liquid fund. A liquid fund is a type of debt mutual fund that invests around 4% in fixed-income instruments such as FDs, trading paper, deposit certificates, etc. Invest your savings in the long run each month and see the magic it can do for you!

Control your spending wisely

If you are paying for a salary and struggling for money by the end of the month, chances are you are living beyond your means. There may be a lot of unplanned expenses! These may not be without money for necessities. But there is a way out of this.

Try to prepare a budget. If you do not have a budget, you can not control your cash flow. The budget shows how much money you are getting and how those funds are being spent.

Start by categorizing your expenses as fixed and variable; Urgency and urgency; Requirements and luxury; Avoidable and unavoidable. This way, you will create a complete list of your front expenses. As long as you change things from abstract to physical, you hold them well.

You can create a hierarchy of needs and decide what to fix first. It prioritizes everything. You have to accept that you have limited resources and unlimited desires. But you have to manage your resources. The sooner you accept this fact, the more you can control your motivations towards avoidable cost.

After settling all the necessary expenses, you can allocate some money for entertainment and leisure. To avoid high costs, you can create a list of groceries before visiting the department store. You can also set aside a non-spending day of the week.

Make sure you stick to your budget. Consider it a commitment rather than a burden and adhere to boundaries.

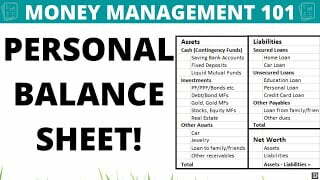

Manage personal balance sheet

Having a personal balance sheet can help you figure out what you own and what you owe! It is a very powerful tool to take your finances to the next level. It is a statement that you can register your assets and liabilities. The difference between your assets and liabilities shows your personal net worth.

Before you begin, prove your bank statements and other obligations. Then, list your assets such as bank balance, investments, home value and other asset value. Take the sum of all the assets to reach the total value of your assets.

Also, list your liabilities such as car loan, home loan, credit card balances and other balances on other loans. The sum of all liabilities shows the value of the money you owe.

Ideally, your net worth should be positive, which means that the money you have is more than the money you owe. Do not lose heart if it is negative. As you repay your debts, your net worth gradually increases.

Furthermore, another critical aspect of asset management is what kind of assets you should own. You should always try to own assets that add value and have low maintenance costs. In the end, it’s just about how much you can actually use. Collecting items you don’t need can lead to money being wasted on things that are not productive. It is wise to know what you are really using and what you can get rid of.

Dealing with surplus cash wisely

How you deal with surplus cash will determine your future. When you do not have a plan, you are likely to spend more. This money will be used to make you financially self-sufficient .

How you deal with surplus cash will determine your future. When you do not have a plan, you are likely to spend more. This money will be used to make you financially self-sufficient.

In the face of inflation, as each year passes, everything becomes more expensive. If you do not invest, your money will not grow to close the inflation gap. Otherwise, you will not be able to retire as you wish.

Investing is a great way to deal with excess cash and inflation. It can be used to increase wealth and divert it to goal achievement. The sooner you start investing the better. Investment is the bridge between where you are and where you want to be.

Start identifying goals such as buying a car or planning for retirement. Classify those goals into short-term and long-term. The goals that can be achieved in 1 to 3 years are short-term. Targets that require a 3-5 year horizon are called medium-term goals. Goals that require more than 5 years to achieve our long-term goals.

Identify your risk appetite means the degree to which you are comfortable with the fall in the value of your investment. If you can digest, say 20% fall in investment value, you are a high risk seeker. Otherwise, classify yourself as a risk-free investor.

Once you have identified your goals and risk appetite, you can conveniently choose an investment paradise. Risk seekers can go for a diversified equity fund. Conversely, a risk-averse short-term investor may move to a liquid fund or a balanced fund.

Mutual funds have become the most versatile investment paradise. You can launch a Systematic Investment Plan (SIP) for a nominal amount of Rs.500 per month. Under SIP, a fixed amount is deducted from your savings account and invested in the mutual fund scheme of your choice.

Create your personal investment portfolio

Building your first investment portfolio is a success. After all, it is your first step towards accumulating wealth. Building a portfolio is about distributing your investment between asset classes such as equity, debt and cash. This is called asset allocation.

Although equity is the best tax-effective and anti-inflation vehicle, it is not prudent to put your money in equity. You need to diversify the amounts to be allocated in each property class according to your investment goals. It is always wise to be a long term investor in order to accumulate more corpus.

Your investment horizon is ideally 10-15 years. Once you have built a portfolio, you need to periodically balance it to keep the portfolio risk within the expected limits due to market fluctuations. You can do this every six months or once a year.

Planning for retirement

Retirement planning is important for everyone. Due to a sedentary lifestyle, you are more likely to suffer from illnesses like diabetes, high blood pressure and heart attack. Health care costs are rising every year. When there is no social security net, you must have your own funds to fund all of these costs.

Like most people, you may think it’s too early to start planning now. At this rate, you’ve started the retirement plan late and will be collecting less money compared to what you started earlier. The reason for this is the “magic of compounding”. This will allow you to retire quickly and live a trouble-free life.

When planning for retirement, you need to clarify a few things, such as determining the age at which you want to retire. In addition, estimate how much money you will need each month to cover your post-retirement expenses.

If you want to retire at the age of 60 and your monthly estimated cost after retirement is Rs. Suppose 50000. Assuming a 12% return rate, you get Rs. 1 SIP of Rs. 2,900 per month for 30 years to accumulate 1 corpus. Crore. You can easily calculate your retirement contribution using our retirement calculator.

Manage your debt wisely

Lack of debt management can eat up a major portion of your payments. You may end up taking out new loans to pay off old debts. If it’s out of control, then you’re in debt. Your critical life goals may be sidetracked and your retirement may even be delayed.

Doing your loan repayment strategy can keep you away from such problems. All you need to do is let them know how much you owe them. Chalk the schedule to pay them. If you have a lot of debt, start paying off the most expensive ones first.

Of course, credit cards are the most expensive debts. As soon as your salary is credited each month, pay off your credit card balances in full. Do not fall into the trap of paying the minimum balance. Before you know it, interest in eating up your savings will increase. Use credit card only in emergencies.

Always keep debt as a last resort. Whenever possible you should have all of these components in place for launch to maximize profits. If you are taking out big-ticket loans, look for a balance transfer option. Offering a lower interest rate you can transfer your loan to another bank. This method can help you save a lot of money in the form of interest.

Never borrow for declining assets. In addition, tax-inefficient loans such as personal loans should be avoided as much as possible. You can think about saving and building a corpus to accomplish your goals. In this way, you can avoid falling into the trap of debt.

Cover your losses

Human life and property are at risk. These risks can lead to loss of income and financial risk to you and your dependents. Just like investing for wealth accumulation, ensure wealth protection through insurance.

Buying a ULIP is not everything. You will have to pay more and not be insured enough. Instead, it would be wise to buy a term insurance plan. Term insurance plan offers you high risk coverage at an affordable price. Do not expect returns from your life insurance policy. Ideally, the sum insured should be at least 10 times your annual income. Before buying life insurance, you can compare policies online to choose the one that meets your needs at affordable prices.

In addition to life insurance, you may also need health insurance. It allows you to access high-quality health care at affordable prices. Do not end up shelling large amounts for less.

Plan your estate

Believe it or not! Each of us has an estate. Whether it is your vehicle or your home; Cash in your savings and current account, each property is an estate. It is your job to discover what that is and to bring it about.

You need to make sure that the right property is allocated to the right person in the right way. Finally, you need to think about estate planning. Often, people misunderstand that estate planning is only for the wealthy. However, the fact is quite the opposite. This applies to every person who can not leave his property in the hands of unwanted people after he is not around.

Most of us may never think of doing estate planning. Some of us may be postponing it to a later date. But this is the wrong approach. You can start planning the estate as soon as you start accumulating assets. You can start by preparing your own list of assets. Create a list of beneficiaries & asset ratio that you want to allocate to each.

Prepare a will that will be the best help to your loved ones. This ensures that beneficiaries do not have to face challenges to gain ownership of the property. If you do not know how to do things, consult an experienced lawyer.

Plan how you can reduce the taxes you have to pay

You need to evaluate your financial situation from a tax efficiency perspective. You can claim various tax deductions, deductions and benefits to reduce your tax liability at the end of the financial year.

Although the tax plan is very legal, you need to make sure that you do not commit tax evasion or tax evasion. There are several deductions available in the Income Tax Act from Section 80C to 80U.

The most effective way to take advantage of Section 80C is to invest in an Equity Linked Savings Scheme (ELSS). It has the shortest lock-in period compared to all other tax saving options available under Section 80C.

Under this section, you can save up to Rs 45,000 in taxes and get a deduction of up to Rs 1.5 lakh. In addition, ELSS is a diverse equity fund that helps you achieve your financial goals by investing in the equity market.